Rystad Energy: 55 CO2 carriers needed by 2030

A fleet of 55 carbon dioxide (CO2) carriers will be required by 2030 to meet the upcoming demand from the offshore storage projects, according to Rystad Energy, which estimates that more than 90 million tonnes per annum (tpa) of CO2 will be shipped by the end of the decade.

The estimated volume will require 48 terminals to handle the import and export of the gas. Onshore pipelines, the most common mode of transportation of CO2 at the moment, are expected to expand to 330 by 2030. These pipelines are ideal for transporting large quantities of CO2 to onshore storage sites or coastal terminals.

Offshore pipelines are larger and they transport captured carbon to underwater storage sites. They are expected to play a vital role in the supply chain in the coming years. CO2 shipping is the third piece of the puzzle and the most flexible solution for carrying carbon emissions over long distances at a relatively low cost.

That being said, the shipping industry relies on emissions-heavy conventional fuels like maritime diesel or low-sulfur fuel oil (LSFO), calling into question the environmental impact of the process. The greenhouse gas (GHG) emissions over shorter distances may be relatively low, but the impact multiplies quickly over longer journeys.

Based on Rystad Energy’s research of CO2 shipping routes that could come online in 2030, ships traveling long distances could emit as much as 5% of the total CO2 shipped. Switching to LNG as the shipping fuel could cut emissions by 18%, while blue-methanol would result in a 20% drop. The real reduction would come with the use of blue ammonia, which would slash the emissions impact of the shipping process by up to 80%.

GHG emissions for marine fuels are calculated well-to-wake, including associated emissions in the fuel’s upstream production, refining and end use. Emission estimates are based on a vessel with a 25,000 cubic meter capacity, according to the Oslo-based energy research and consultancy firm.

“Carbon dioxide shipping is a nascent market now, but it’s set to play a significant role in the global climate solution in the coming years. However, questions remain about the environmental impact of the process. In an ideal world, CO2 tankers would use renewable fuels with no associated emissions. However, these fuels are too expensive now to be economically viable,” Lein Mann Bergsmark, vice president supply chain research, Rystad Energy, said.

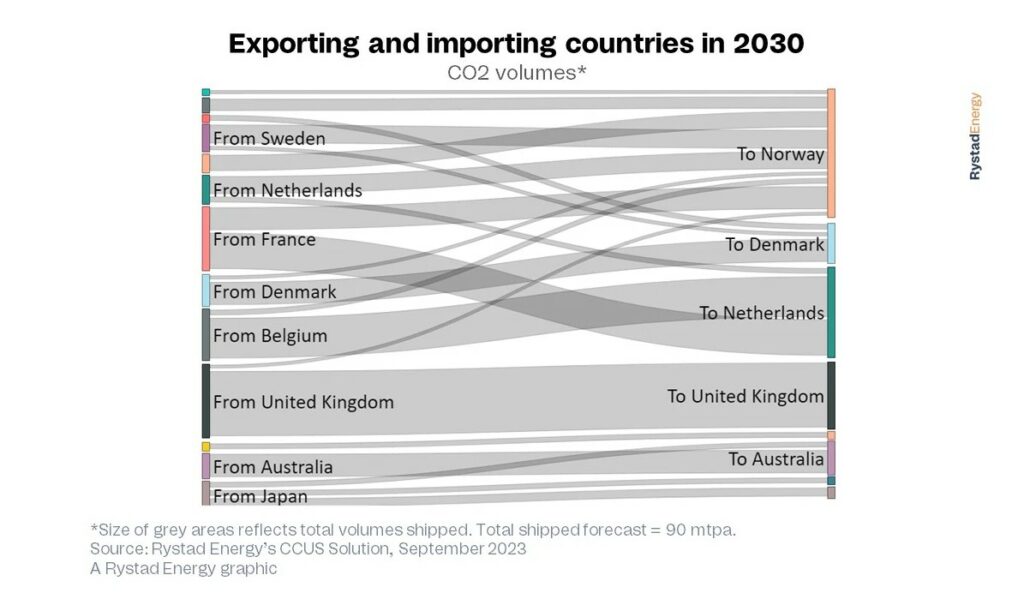

The North Sea is set to take center stage in the CO2 shipping surge due to its proximity to major populated areas in Northern Europe. Norway looks set to account for about 30% of all shipped carbon dioxide globally in 2030 with 26 million tpa, based on announced projects and memoranda of understanding (MOUs) – although this hinges on whether storage sites can be developed quickly enough.

The Netherlands follows Norway, with 23 million tpa, and the UK, with about 20 million tpa of forecast shipping volumes. These totals include the shipping of domestically captured CO2 plus imports from other countries. For instance, the UK has prolific subsurface storage potential and an ambitious CO2 storage target, so it will likely prioritize storing its emissions rather than shipping to its North Sea neighbors.

France is expected to ship 17 million tpa of CO2 in 2030, followed by Belgium at 13 million tpa. These countries do not have ample opportunities to store their CO2 emissions domestically, so the chance to ship CO2 to neighboring European countries will help fast-track CCUS developments.

The Northern Lights Project in Norway is set to be the first open-source CO2 transport and storage network when it opens in early 2025. The project will receive domestically shipped CO2 and volumes from northwest Europe at its onshore terminal before piping and storing the gas under the seabed. Phase one of the project will store up to 1.5 million tpa of CO2. This looks set to be the first of many such projects, each with nuances, but all will involve receiving shipped CO2 to store underground.