Houthis could partner with Iran, Somali pirates on Indian Ocean attacks

Yemen-based Houthi militants could keep the promise to extend their attacks to merchant ships in the Indian Ocean, potentially with drones and assisted by Iran and Somali pirates, security specialists said.

Since the war between Israel and Iran-backed Hamas broke out on Oct. 7, the Houthis have launched more than 60 attacks on commercial ships around the Bab al-Mandab Strait — mainly with missiles and unmanned aerial vehicles — and claimed those were in support of the Palestinians.

The rebel group, also backed by Iran, earlier this month vowed to target Israel-linked ships sailing to the Cape of Good Hope in what it described as an “advanced and major” step, putting the shipping industry on alert.

“We perceive the threats to be credible on the basis that until now, the Houthis have generally followed through on the threats they have issued,” said Jakob Larsen, head of maritime safety and security at BIMCO, the world’s largest shipowners’ association by direct membership.

Just as in the strait, Houthi rebels are expected not only target ships associated with Israel in the Indian Ocean but those with the UK and US, which have conducted airstrikes on Houthi-controlled areas since January.

But others could also suffer collateral damage. Tankers with Russian oil and Chinese ownership have also been attacked, possibly due to a lack of updated data, even though the Houthis reportedly told Beijing and Moscow their ships could enjoy safe travel.

Houthis’ expanded threat area could cover as far south as Tanzania and as far east as 69 degrees east longitude, with their UAVs having a range of up to 2,500 km, security consultancy Ambrey said in a recent note.

This covers the whole of the high-risk area in the Indian Ocean listed by the Lloyd’s Market Association, where marine insurers’ additional war risk premiums apply.

Some Houthi drones configured for reconnaissance could be “flown into a ship on purpose with limited effect,” while the information is lacking on whether their explosive-laden suicide drones could be operated in a similar manner during the terminal phase, Larsen told S&P Global Commodity Insights.

Meanwhile, Ambrey suggested the Houthis also have missiles with an arsenal of 1,900 km. But the long-range ballistic weapons do not have effective terminal guidance capability and might not accurately target a moving ship, according to Larsen.

Allies of Houthis

With international navy forces diverting their resources to protect merchant ships in the Red Sea, security reports suggest a potential resurgence of Somali piracy since late last year.

The pirates kidnapped some dhows, the 41,600-dwt bulk carrier Ruen and the 58,100-dwt Abdullah in recent months, though the Indian navy managed to recover the Ruen when it was used as an attack ship.

Scarlett Suarez, an analyst with maritime risk advisory Dryad Global, said the incidents were not home grown but demonstrated “a high level of coordination between the Houthis and Somali pirates, including elements of Al Shabbat.”

The Houthis could use dhows as forward operating bases to conduct asymmetric warfare, including the use of remote controlled waterborne improvised explosive devices, according to Ambrey.

Meanwhile, Iran, reportedly suspected by the US to be behind the attack on the Liberia-flagged, 21,300-dwt tanker Chem Pluto off India last December, could also assist the Houthis in expanding their target range.

“Iran could also conduct operations and the Houthi officially claim responsibility,” Ambrey said.

Suarez said there is “a distinct possibility” the latest Houthi threat materializes, with their coordination with Iran, Somali pirates and other militant groups enhancing their capability in attacking commercial ships.

Counter measures

Many ship operators have diverted vessels away from the Red Sea to sail around Africa on longer routes for crew safety, offering support to bunker consumption and freight rates in some trades.

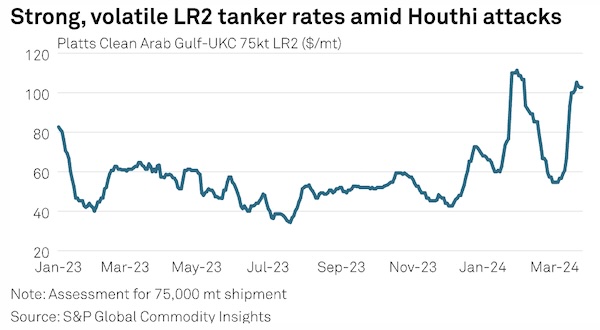

Partly due to tight tonnage supply, the LR2 tanker rate for shipping 75,000 mt of clean petroleum products stood at $102.67/mt March 25, according to S&P Global’s Platts assessment. This was $80/mt higher than the level seen on Dec. 4 before the Houthi attacks intensified.

Looking forward, shipping companies, especially those with links to Israel, the UK and US, could divert vessels farther away from the Houthi target area, as security specialists suggest other counter measures could be too costly and require additional permission from flag states.

“Jamming solutions are relatively expensive and most likely outside the scope of normal commercial ships,” Larsen said. “Hard-kill systems such as guns, missiles or ‘killer-drones’ are expensive to purchase, require training and dedicated personnel to maintain and operate, and some will also classify as weapons and will be difficult to get permission to use on-board commercial ships.”

While insufficient to offer full protection to all ships in the Red Sea, international naval forces could still escort low-risk ships via the Red Sea when such voyages are necessary, according to analysts.

“It is best to use ships that fall outside the attack criteria established by the Houthis,” Larsen said.